AddingBitcoin for Merchants

Add a Bitcoin Cash (BCH) payment option to your business because it helps you

- New business - Nerds seek out and prefer businesses that accept Bitcoin Cash

- Cash-in-hand - Instant, cleared payment. No waiting for funds from card processors

- Hard money - Fixed supply, non-government money, that can’t be inflated by banks

- No chargebacks - Receive online easily and safely with no fraud risk

Do you accept Bitcoin Cash yet? Plenty of other merchants already do.

Adding Bitcoin Cash payment option - is it right for you?

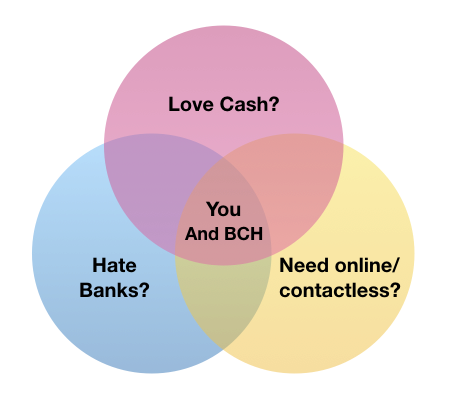

Bitcoin Cash should resonate with you if:

- you feel that “Cash is King”

- you are worried about inflation from money printing policies

- you need contactless or online payments for your business

If the above applies to you then you should add Bitcoin Cash to your business. It’s easy - generate an address (similar to an IBAN) and give it to your customers online and in person. Let your suppliers know that you can pay in Bitcoin Cash too.

Questions or Concerns?

Here are some common reservations:

- Is it worth the learning curve - even though it’s free, is it worth the effort?

- It may not make sense if your businesses currently has cashflow problems (or convert immediately to Euros - see volatility below)

- For many most businesses, it is worth it for gaining (or keeping) a niche of loyal customers

- Volatility - the price in Euros changes all the time

- You can remove volatility risk entirely, by converting immediately into Euros at the time of payment. This is done by using a payment processor. Or we can do it at cost for 3 months to help you get started

- Note that you can also pay your suppliers in BCH - using it as money and stimulating the local Berlin economy. And position your business for potential increases in price

- Your financial risk exposure is low because only a small percentage of your turnover would be in BCH

- With fixed supply and use as money, the long term expectation of supply and demand is that the price in Euros will go up. This is over the long term - say 3~5 years - and of course not guaranteed

About Us

AddingBitcoin is a non-profit, merchant-focused collection of resources for business owners to understand, accept and pay their suppliers in Bitcoin Cash.

It is run by volunteers who believe in the benefits of non-government hard money. Hard money doesn’t need a trusted third party like a PayPal, Facebook, or central bank.

There were many attempts at electronic money before Satoshi Nakamoto’s invention - and many afterwards too. But as it stands today, Bitcoin Cash looks like the most likely to succeed.

How? Tax, Accounting and Practical Steps

- Set up a BCH wallet on your phone

- We recommend Bitcoin.com wallet

- Write your twelve-word seed by hand. On a pad and keep that safe, eg with your passport

- Click receive on the app and note your BCH address, which works similarly to an IBAN

- Add a ‘Bitcoin Cash’ button on your point-of-sale system

- Minimal staff training, they enter Euro amount and the new BCH button instead of Card or Cash

- Add Bitcoin Cash payment type on your back-end accounting system

- It is legal, private money in Germany, you don’t need permission from the state or your accountant

- Advertise your BCH address to customers and suppliers

- Add it to your website front page, and at checkout

- Add it to your invoices, near your IBAN bank details

- Add it to remittance advice slips to suppliers

- For in-person, ‘bricks and mortar’ sales then either:

- Print a branded ‘clipboard sheet’ to hand to customers, freeing up your staff for other tasks

- Take payments on a tablet or similar device using the Cash Register App.

See more details in the Quick Start PDF.

Why we believe in Bitcoin Cash

Money: Bitcoin Cash is money. Rather than simply physical notes, think of money as a veil over barter - a medium of exchange that has value only because we know we can exchange it for other goods and services.

Cash: Cash is a type of money that can’t be revoked. Once it’s in your hand (or wallet app), it’s yours. Electronic money via banks and payment processors aren’t cash. Not because they’re electronic though, but because the money is the bank’s money - it isn’t really yours. What you have instead is a promise from the bank that you can receive that money in the future. Bitcoin Cash is cash because once you receive it to a wallet that you control, no-one can revoke it or limit your spending. Just like notes. In contrast, banks’ promises are not kept in many instances:

- Chargebacks take previously credited funds away from you

- Limit withdrawals to keep a minimum balance

- Bank runs, complete or partial, such as the €100/day limit in Cyprus, in 2013

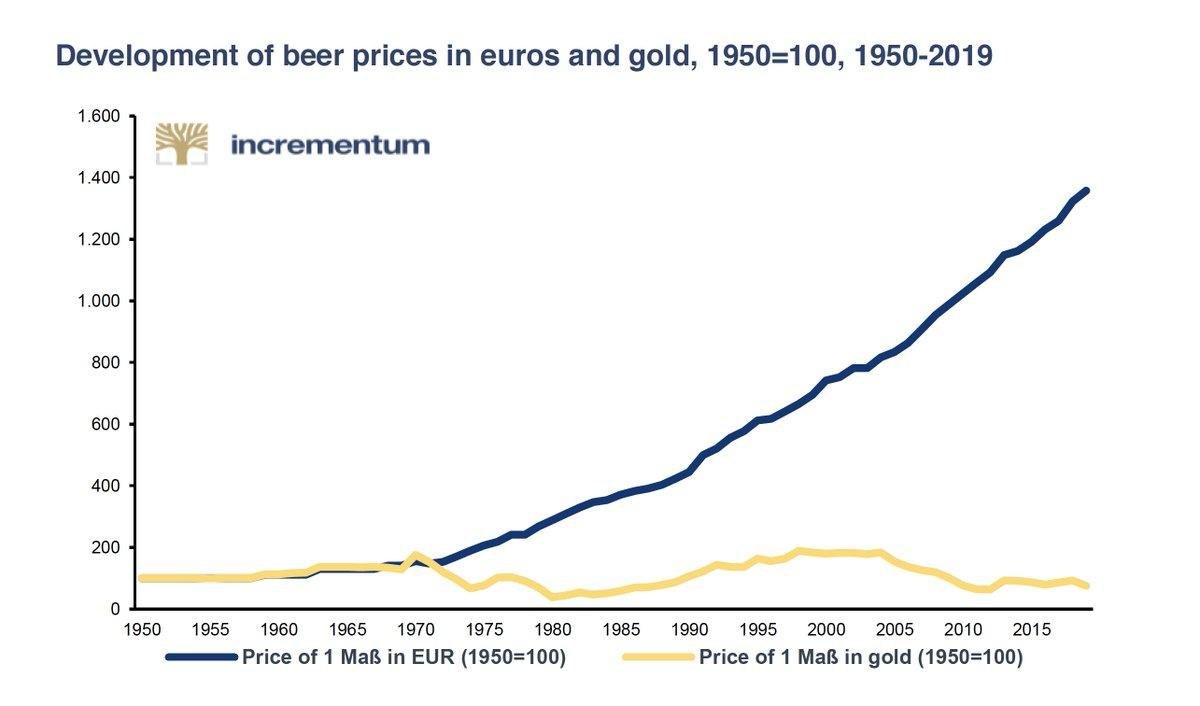

Hard Money: Bitcoin Cash is hard money because it has a fixed supply; additional units can’t be ‘printed’ by banks or government central banks. Historically, Hard money meant coins made out of precious metal commodities such as gold or silver; or currency whose value ties directly to a specific commodity. Fiat money, in contrast, isn’t tied to any fixed supply, and so can be inflated at will.

Over the long term, inflating or ‘printing money’ means everyone’s purchasing power is reduced - each unit of money buys you less goods. Think of the Weimar Republic, Mugabe’s Zimbabwe, or present-day Venezuelan Bolivars.

Those are extremes, but the principle applies to moderate inflation in the Eurozone today - as shown in the prices of one litre (1 Maß) of beer, below.

Make this website clearer

We welcome improvements - please open an issue on GitHub.

Editorial Policy

- Act in the best interests of the merchant. Be honest, especially if adding Bitcoin Cash may not help their business. Make recommendations based on best fit for the merchant - accept no inducements from platform providers to recommend their services

- Make single recommendations. One wallet, one point of sale solution, one web payment button, etc. Decisions slow down adoption. After a merchant has started, they will have a better idea of their needs and can evaluate additional options at that time